July 24, 2024

Considerations in application to our client's review of similarly situated scenarios include:

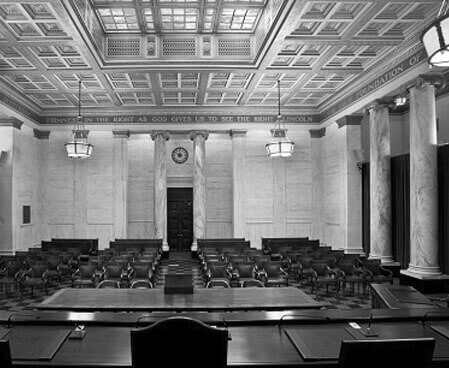

- If the client is requesting trial de novo, a motion for trial de novo must be filed within twenty days in the First and Fourth District's jurisdiction or it will not be granted.

- If the client misses the 20-day deadline, it may obtain relief by filing a motion for relief from judgment under rule 1.540(b).

- If the opposing party files an untimely motion for trial de novo, it should be opposed in all jurisdictions.

View the opinion here.

Continue...

July 10, 2024

Continue...

July 3, 2024

The committee is dedicated to enhancing the professional development and educational opportunities of Florida Registered Paralegals through various outreach programs and educational initiatives.

Ananta brings a wealth of experience to this role, having served as a Florida paralegal prior to pursuing her law degree at St. Thomas University. Her background uniquely positions her to contribute to the committee’s mission, and we look forward to her valuable insights and active involvement.

For more information about the paralegal committee, click here.

Continue...

July 2, 2024

Mark experienced a transformative presentation by Siddh Guru titled "Lessons on Peak Performance, Health, and Family." Siddh Guru enhanced his teachings with insights gained from his extensive travels to over 192 countries, all dedicated to the benefit of humanity.

Did you know?

Hinduism has 1.2 billion followers, making it the third largest religion in the world, following Christianity and Islam.

Thank you, Mark, for participating in this enlightening event and bringing back valuable insights for us to learn and grow from.

Continue...

June 27, 2024

The committee's mission is to advance diversity and inclusion in the local legal community through educational initiatives, community outreach, and social engagement, promoting an inclusive environment that respects people of varied backgrounds, religions, sexual orientations, and abilities. We look forward to Benjamin's impactful contributions in furthering these goals!

Continue...

June 25, 2024

On the first day, she attended the Blue and Gold E-Board Installation Gala, hosted by the Florida Association for Women Lawyers (FAWL). Tracie is set to serve as the 2024-2025 Journal Committee Chair.

On the second day, she was sworn in as Secretary of the Virgil Hawkins Florida Chapter of the National Bar Association.

Additionally, she participated in FAWL’s Executive Board Retreat and attended the Henry T. Latimer Awards Luncheon, formerly known as the Diversity Equity and Inclusion Committee Luncheon.

We are proud of Tracie's dedication to networking and professional growth, and we congratulate her on her achievements!

Continue...

June 24, 2024

Super Lawyers is a rating service of outstanding lawyers who have attained a high-degree of peer recognition and professional achievement. Selections are made on an annual, state-by-state basis and to be selected, peer nominations and evaluations are reviewed and combined with independent research.

To learn more, visit superlawyers.com.

Continue...

June 19, 2024

The gala celebrated the current and incoming officers and directors of the Miami-Dade Bar and introduced Charise Morgan as the President for 2024-2025, and Lauren Allen as the President of the Young Lawyer Section.

Continue...

June 12, 2024

Continue...

June 11, 2024

Continue...

June 4, 2024

The law clerk program is led by Jennifer Remy-Estorino and Nicole Wulwick from our Miami office, and Maegan Bridwell from our Tampa office. They focus on recruiting highly-motivated law students with top academic credentials to be paired with a mentor who provides opportunities for hands-on experiences alongside shareholders and associates. The program’s goal is to empower students to develop skills that will be critical in transitioning from the classroom to the courtroom. The experiences they receive will serve as a cornerstone to their career, hopefully here with the KD family.

Successful summer clerks are considered for associate positions upon graduation and bar admission. For more information about our program, please contact careers@kubickidraper.com.

Continue...

May 28, 2024

The organization was formed to recognize the industry's best advocates and have them join to support the retention of trial by jury, professionalism, and ethics. Membership is by invitation only and involves a rigorous screening process that considers the individual's ability, experience, accomplishments and ethical standards as assessed by trial lawyers and judges. For more information, please visit www.isob.com.

Continue...

May 24, 2024

Continue...

May 23, 2024

This program involves collaboration between the St. Thomas law students and the Law Magnet Program at Miami Carol City High School. Under the guidance of Asiah Wolfolk-Manning, lead teacher for the law magnet program, St. Thomas law students assisted the high school participants in developing trial techniques in preparation for their final exam which is the Spring Mock Trial Competition. Students played the roles of state attorney, defense attorney, expert witness, and lay witness. In addition, there were several Florida attorneys, former judges, and Palermo Mentorship alumni who served as judges for the competition.

Continue...

May 21, 2024

Continue...

May 20, 2024

The National Black Lawyers is an invitation-only professional development and networking association comprised of the top African American attorneys from across the country.

Kudos to Ashley for this well-deserved recognition!

Continue...

May 17, 2024

Transition is a non-profit organization dedicated to helping those who have been incarcerated to find employment, rebuild their lives, and have a successful transition back into society.

Continue...

May 3, 2024

Continue...

April 29, 2024

How will this ruling affect current and future cases? Please contact us to discuss.

Continue...

April 18, 2024

Continue...

.png)