ourPractices

In response to the growing needs of its clients, the firm began expanding in the early 1980's and today is a diverse full-service law firm providing trial, appellate, coverage, commercial and real estate transaction services.

browse our practice areas

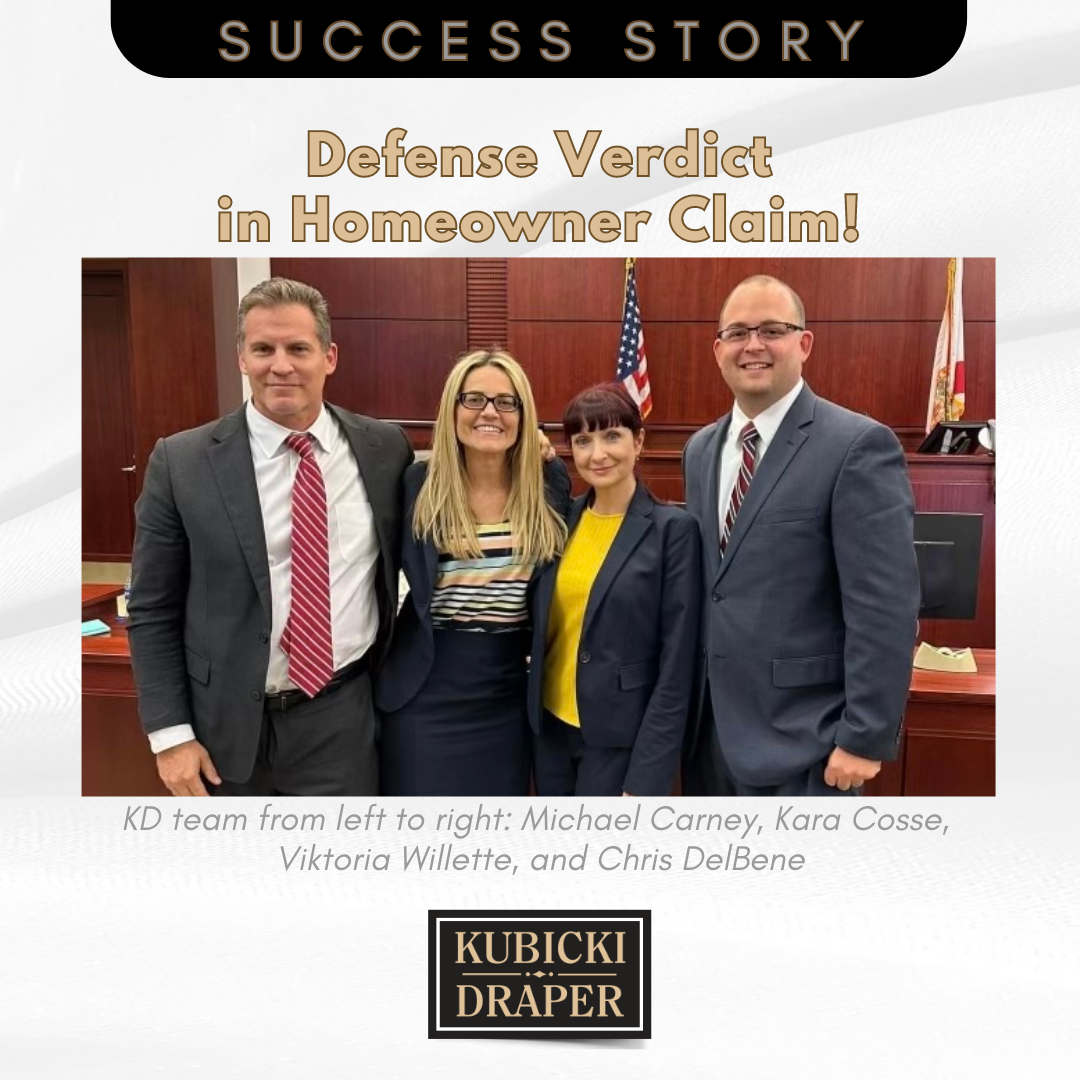

ourresults

Kubicki Draper enjoys a national reputation for expertise in the handling of complex, high stakes litigation matters, as well as, appellate, general commercial and real estate practice.

preview our results

ourreach

With a dozen offices throughout the State of Florida and other key points in the southern parts of Georgia, Alabama, and Mississipi, our firm is familiar to every venue statewide and will never get home-teamed.

find the location near you

.png)